Why Credit Card Terms Matter

Credit card agreements aren’t just legal formalities—they’re the rulebook for your relationship with the card issuer. These documents outline what you can expect to pay, what benefits you’ll receive, and what happens if things go wrong.

Understanding these terms helps you:

- Avoid surprise fees and interest charges

- Maximize your card’s benefits and rewards

- Make informed decisions about how and when to use your card

- Know your rights as a cardholder

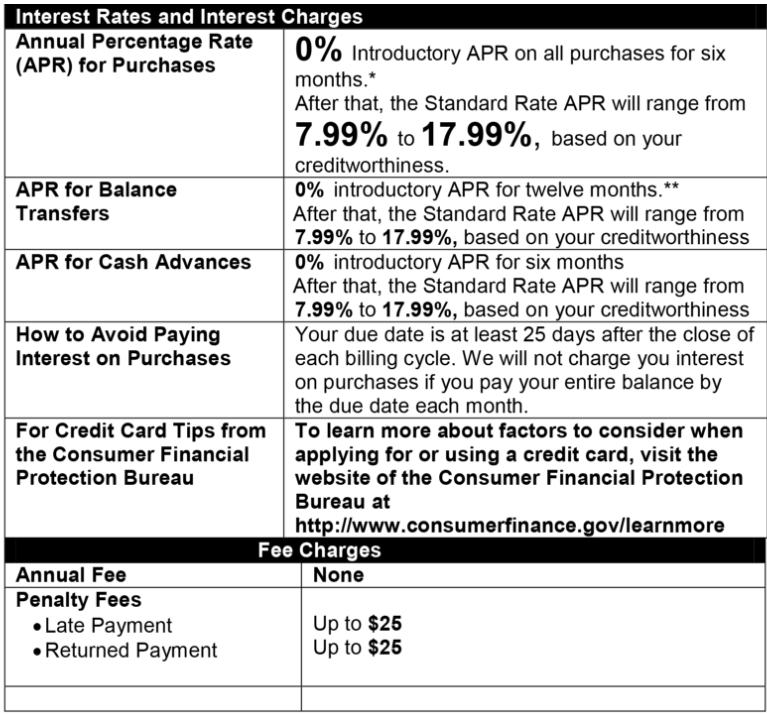

Decoding the Schumer Box

What You'll Find in the Schumer Box:

Annual Percentage Rate (APR): This is the yearly interest rate you’ll pay if you carry a balance. Credit card APRs typically range from 15% to 25% or higher, depending on your credit score and market conditions.

For example, if your card has an 18% APR and you carry a $1,000 balance for a year without making payments, you’d accumulate about $180 in interest charges.

APR Types: Your agreement will list different APRs for:

- Purchases

- Balance transfers

- Cash advances

- Penalty APR (applied if you miss payments)

Fees: This section details all potential charges, including:

- Annual fee

- Late payment fee

- Balance transfer fee

- Cash advance fee

- Foreign transaction fee

- Over-the-limit fee

Grace Period: This is the time between the end of a billing cycle and when your payment is due. During this period (typically 21-25 days), you won’t accumulate interest on new purchases if you paid your previous balance in full.

Beyond the Schumer Box: Other Important Terms

Minimum Payments

Your agreement explains how minimum payments are calculated. While making only minimum payments keeps your account in good standing, you’ll end up paying much more in interest over time.

For instance, paying only the minimum on a $3,000 balance with an 18% APR could take over 10 years to pay off, costing thousands in interest.

Credit Limits

Rewards Programs

If your card offers rewards, the terms will explain:

- How you earn points, miles, or cash back

- Point values and redemption options

- Expiration policies

- Restrictions or caps on rewards

Cardholder Benefits

Many credit cards include benefits beyond rewards, such as:

- Purchase protection

- Extended warranties

- Travel Insurance

- Rental car coverage

- Fraud protection

Understanding these benefits can help you maximize your card’s value and avoid paying for services you already have through your card.

Changes to Terms and Conditions

Card issuers reserve the right to change your terms and conditions but must notify you before implementing significant changes. Your agreement explains:

- How you will be notified about changes

- Your right to opt out of specific changes

- What happens if you reject new terms

How to Access Your Cardholder Agreement

Understanding Your Monthly Statement

Finding your entire credit card terms and conditions is easier than you might think:

- Check your mail or email when you first receive your card

- Log into your online account and look for “Account Details” or “Card Agreement”

- Call the customer service number on the back of your card

- Visit the card issuer’s website

- Search the Consumer Financial Protection Bureau’s credit card agreement database

Tip: Save a digital copy of your agreement for easy reference later.

Your monthly statement provides a snapshot of your account activity and reflects the terms outlined in your agreement. Key elements include:

- Statement closing date

- Payment due date

- Current balance

- Available credit

- Minimum payment due

- Interest charges

- Fees assessed

- Rewards earned

Reviewing your monthly statement helps you track your spending, confirm your rewards, and quickly catch unauthorized charges.

Making Credit Card Terms Work for You

Choose the Right Card

Different cards have different strengths. Based on your spending habits, you might benefit from:

- A low-interest card if you occasionally carry a balance

- A no-annual-fee card if you’re a light spender

- A rewards card aligned with your spending categories

- A balance transfer card if you’re working to pay off debt

Avoid Common Fee Traps

Once you understand potential fees, you can take steps to avoid them:

- Set up automatic payments to avoid late fees

- Stay well below your credit limit

- Use your card’s app for fee-free cash access options

- Check foreign transaction fees before traveling

Maximize Your Grace Period

To fully benefit from your grace period:

- Pay your balance in full each month

- Time large purchases early in your billing cycle to give yourself more interest-free time

- Know exactly when your grace period ends

Commonly Asked Questions

What should I do if I don’t understand a term in my credit card agreement?

Contact your card issuer’s customer service team for clarification. Representatives can explain confusing terms in plain language. You can also consult financial education resources or speak with a financial advisor.

Can credit card companies change my interest rate?

Yes, but there are rules. For new purchases, issuers must give you 45 days’ notice before increasing your rate. Rate increases generally can’t apply to existing balances unless you’re more than 60 days late on payments.

What’s the difference between a variable and fixed APR?

A variable APR can change based on an index rate (usually the prime rate). A fixed APR doesn’t fluctuate with the market, but the issuer can still change it with proper notice.

How do I get a lower APR on my credit card?

You can call your issuer and request a lower rate, especially if you have a good payment history or have received better offers from competitors. Improving your credit score will also help you qualify for better rates over time.

What happens if I can’t make my minimum payment?

Contact your card issuer immediately. Many have hardship programs that can temporarily reduce payments or interest rates. Missing payments without communication will damage your credit score and may trigger penalty APRs.

Take Control of Your Credit Cards

Understanding credit card terms and conditions empowers you to make better financial decisions. By familiarizing yourself with your cardholder agreement, you can avoid unnecessary fees, maximize benefits, and use credit as a tool rather than falling into debt traps.

Remember, credit cards aren’t good or bad—how you use them depends on your knowledge and habits. Taking time to learn the rules of the game puts you in control.

Next time you receive a new credit card, set aside 15 minutes to review the terms and conditions. Your future self will thank you for avoiding surprise fees and maximizing your card’s benefits.